Aerospace Supply Chain Crisis to Cost Airlines Over $11 Billion in 2025, IATA Reports

Persistent challenges in the global aerospace supply chain are projected to generate over $11 billion in excess costs for airlines during 2025. This figure comes from a joint study released by the International Air Transport Association (IATA) and specialized consulting firm Oliver Wyman, which analyzes the impact of delays in aircraft and component production.

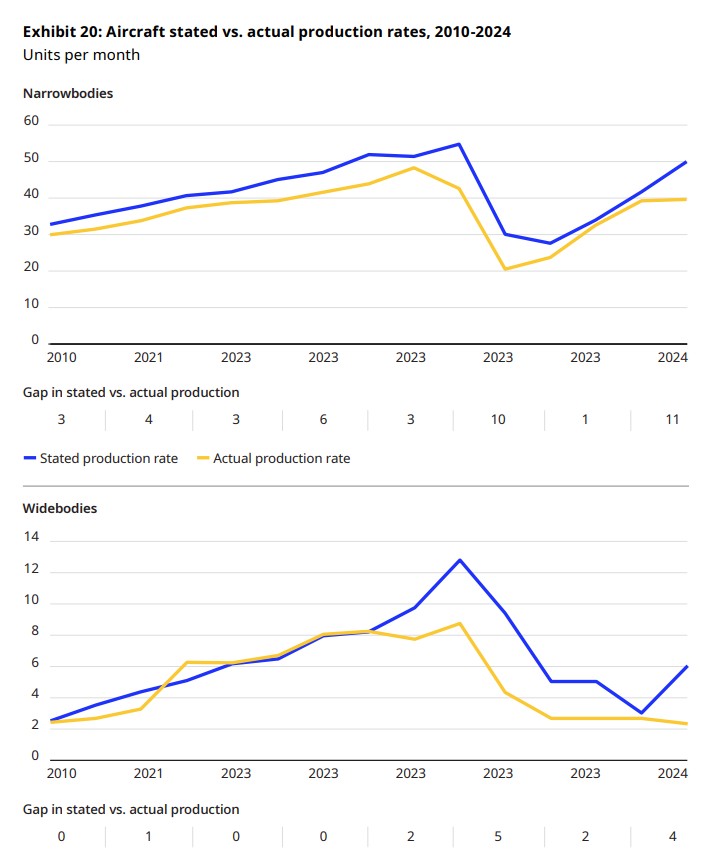

The report, titled "Reviving the Commercial Aircraft Supply Chain", details that the worldwide commercial aircraft backlog reached a record of more than 17,000 units in 2024. This figure significantly surpasses the average of approximately 13,000 aircraft per year recorded between 2010 and 2019, highlighting a growing gap between manufacturers' production capacity and airline demand.

The slow pace of deliveries is forcing airlines to extend the operational life of their older fleets, directly impacting their financial performance. This financial burden is composed of several key areas. The largest portion, $4.2 billion, stems from excess fuel costs, as older aircraft are less efficient. This is compounded by $3.1 billion in additional maintenance expenses, a result of aging fleets requiring more frequent and complex inspections.

The total increases with $2.6 billion due to rising engine leasing costs, as airlines need to rent more units while their own spend more time in workshops. Finally, as detailed in the analysis published by IATA, an estimated $1.4 billion is attributed to surplus inventory holding costs for spare parts to mitigate disruptions.

This situation also prevents the industry from fully meeting passenger demand. In 2024, air travel demand grew by 10.4%, outpacing capacity expansion of 8.7%. This pushed load factors to a record 83.5%, a trend that continues into 2025.

Willie Walsh, IATA’s Director General, stated that "airlines depend on a reliable supply chain to operate and grow their fleets efficiently. Now we have unprecedented waits for aircraft, engines and parts." Walsh added that "there is no simple solution to resolving this problem, but there are several actions that could provide some relief," such as opening up the aftermarket to give airlines greater choice and access to parts and services.

To address the imbalance, the study proposes a collaborative approach among original equipment manufacturers (OEMs), lessors, and suppliers. It emphasizes the need to reform the aftermarket by supporting MRO (Maintenance, Repair, and Operations) shops to become less dependent on restrictive OEM licensing models. This involves facilitating access to alternative material sources and accelerating approvals for replacement parts and Used Serviceable Material (USM) components.

Concurrently, the report calls for enhanced transparency across the entire supply chain to identify risks early and reduce bottlenecks. This is complemented by better data utilization, leveraging predictive maintenance analytics and creating shared information platforms to optimize spare parts inventory and minimize aircraft on-ground time.

Matthew Poitras, a Partner at Oliver Wyman, concluded that they see "an opportunity to catalyze an improvement in supply chain performance that will benefit everyone, but this will require collective steps to reshape the structure of the aerospace industry."

/https://aviacionlinecdn.eleco.com.ar/media/2024/10/estela-avion-cielo-777-generica.jpg)

Para comentar, debés estar registradoPor favor, iniciá sesión