Analysis: a step away from profit, PLAY shows it can make money

Not too many people noticed, but last week Iceland’s start-up PLAY Airlines announced its financial results for the second quarter of 2022.

Albeit the company posted a loss of USD25.6 million with revenues of USD42.2 million, the company showed steady progress towards breaking even. Because that quarter was the one where the airline made its biggest step — starting up its Transatlantic operations –, the airline’s management reported a good progress towards profit.

Naturally the ramp-up incurred costs, and a new route always takes some time to mature; let alone three routes of the magnitude of the ones PLAY started, from Keflavík to Baltimore in April, to Boston in May and to New York/Stewart in June.

Making these flights work is no easy feat: after all, they rely heavily in inbound connections from Europe to be profitable (as per PLAY’s playbook) and, in this regard, PLAY also had its hands full. According to their own presentation, they also started eleven new routes from Europe to its hub in that quarter.

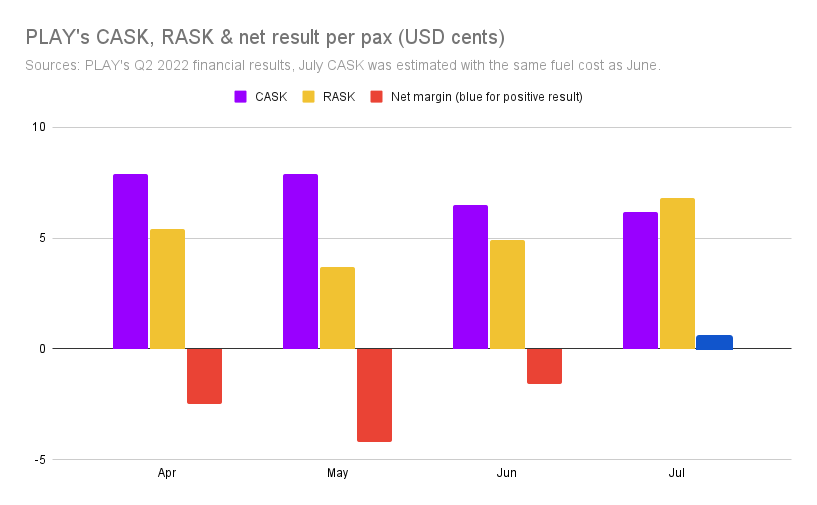

So it is safe to assume that, once these routes mature and once they stop growing capacity, which is an inexorable cost anyway, they will finally turn a profit. According to their report on the second quarter, «PLAY estimates to report a positive EBIT during the second half of 2022».

In fact, computing the data from their Powerpoint presentation and estimating the fuel costs from June to July remained constant, in July they were actually able to turn a small operational profit (July CASK is an estimation by Aviacionline).

That would be a very positive sign for the Icelandic airline, especially considering so much doubt was cast over the airline’s approach to its growth.

One of the greatest points of criticism towards PLAY was that much of its management, and much of its business plan for that matter, came from the ill-fated WOW air, which went bust a year before COVID hit.

But in an interview with Aviacionline last April, PLAY’s CEO, Birgir Jónsson, showed confidence towards their project, saying that «WOW was actually doing really well until the point where they introduced the widebodies. So that was a clear mistake.»

And he then added: «[we will just keep] the machine running for you and not have too grand ideas about being the biggest or most famous or something. We just want to be small and flexible. Adamant profitable.»

Steering clear from WOW’s expansionist megalomania, then, is the main differential between the two airlines. And this is one that seems to be paying off, as PLAY is on track to reach its profitability in this half of the year.

PLAY’s current fleet consists of three Airbus A320neos, with 174 seats, and two A321neos, with 192 seats. During the peak of next Summer season, the airline plans to be operating ten aircraft of the A320neo family.

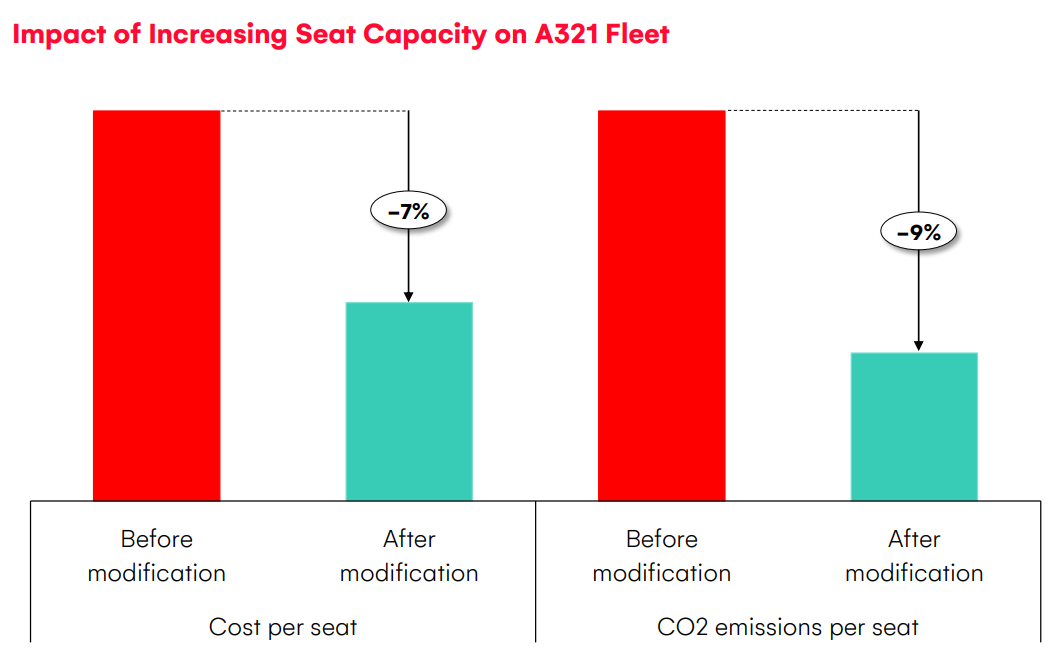

Because the A321s were rushed into service, their configuration, inherited from the previous operator (Interjet) is too light; it still has the potential to carry even more passengers, further reducing unit cost and raising the airline’s margins. This Winter season, PLAY expects to reconfigure the A321 to carry 214 passengers, according to the company’s full year 2021 report.

So this is what defines PLAY; a small carrier that, for now, can be very successful if it holds to its niche market, keeping costs low and keeping its structure simple.

As Jónsson added in April, «the other thing that [WOW] did wrong was that they were owned by one guy […] I mean, we are a listed company. We have 4,000 shareholders.»

«So all our decision-making, all our approach is much more disciplined and focused and kind of maybe a little bit more boring.»

And this «boring-ness» was reflected in their last earnings call. Most airlines, perhaps, would do all sorts of accounting manouvers to boast to everyone that they were actually profitable as they spoke. PLAY, instead, did not, and said that they expected to turn a small EBIT in the second half of this year.

Rhetorically, at least, PLAY is doing its homework. Let’s wait and see if commercially they do so as well.

Para comentar, debés estar registradoPor favor, iniciá sesión